What Are Asset Classes? Comprehensive overview

May 31, 2023Embark on the exciting journey of long-term investing where the pillars of patience, strategic foresight, and the wonders of compound interest combine to build considerable wealth over time. Whether you’re a novice stepping into the investment arena or an experienced investor looking to enhance your approach, this comprehensive guide serves as your compass, guiding you toward more effective long-term investment strategies.

We’ll decode the essential elements of investing, from carving out well-defined investment objectives and gauging risk tolerance, to appreciating the crucial role of portfolio diversification. Witness the transformative power of compound interest and understand how your wealth could expand over time with consistent investment contributions.

We also underscore the vital need to keep costs low by demystifying investment fees and demonstrating their impact on your overall returns. Recognizing the crucial role of financial discipline, we delve into the significance of personal expense management.

To our US readers, we’ll share insights on optimizing the advantages of tax-friendly accounts like Roth IRAs. Wrapping up, we’ll offer actionable advice to keep you informed and equipped to fine-tune your investment approach as circumstances demand.

Step into this exploration, and unlock the potential of long-term investing strategies to bolster your financial growth and secure your future. Welcome to the journey!

Outline Your Investment Goals and Evaluate Risk Tolerance

Before diving into investing, it’s pivotal to set clear goals. What are your primary investment targets? Are you investing for retirement, planning for a major purchase like a home, or funding your child’s education? Your investment approach and timeline can be significantly shaped by your specific objectives.

Just as crucial is understanding your risk tolerance. Some investments come with higher risks and potentially higher rewards, while others offer more stability. Gauge your risk tolerance to strike a balance between risk and reward, avoiding knee-jerk reactions during market volatility.

For instance, if your aim is a comfortable retirement, a diverse mix of stocks and bonds that aligns with your targeted retirement date and income requirements might be ideal. Conversely, short-term objectives such as saving for a down payment on a house may warrant more conservative strategies like high-yield savings accounts or certificates of deposit. Evaluating your risk tolerance will help pinpoint the appropriate asset allocation that aligns with your comfort level and goals.

Master the Art of Portfolio Diversification

Diversification, an essential investing principle, involves spreading your investments across various asset classes (stocks, bonds, real estate, commodities) and geographical locations to mitigate risk and potentially boost returns. This strategy safeguards you from overexposure to a single investment type, reducing your portfolio’s vulnerability to specific market conditions.

A more detailed overview can be found in our Asset Classes article

For instance, if your investments were solely in stocks during a market slump, your portfolio’s value could suffer a substantial hit. However, if your portfolio is diversified across stocks, bonds, real estate, and commodities, losses in one area could be offset by gains in another, thus cushioning the impact of market downturns.

Stay Informed and Conduct Thorough Research

Investing should never hinge on blind faith or rumors. Thoroughly research and understand the investments you’re contemplating. Keep abreast of market trends, economic news, and company performance. Consult trusted financial publications, follow authoritative sources, and consider seeking advice from financial advisors. Knowledge-backed decisions typically yield more favorable investment outcomes.

For instance, when considering a particular company for investment, scrutinize their financial statements, keep updated with industry news, and gain a solid grasp of their business model and competition. Being well-informed helps prevent rushed decisions during market fluctuations, minimizing panic-driven or speculative choices.

But keep in mind that the average investor rarely outperforms the market average returns over the long term. Multiple studies, including those from DALBAR, a financial services market research firm, consistently find that individual investors often underperform relative to market indices. This underperformance is largely due to factors such as poor timing decisions, emotional trading, lack of diversification, and high transaction costs. In particular, the temptation to time the market – buying and selling based on short-term predictions – often leads to buying high and selling low, which can significantly erode returns. As a result, many financial advisors advocate for a buy-and-hold strategy and investing in low-cost index funds that aim to mirror the market’s performance, rather than trying to beat it.

Cultivate a Long-Term Investment Mindset

Investing demands patience and a long-term viewpoint. It’s not just about investing money; it’s also about investing time, thanks to a powerful principle known as compound interest.

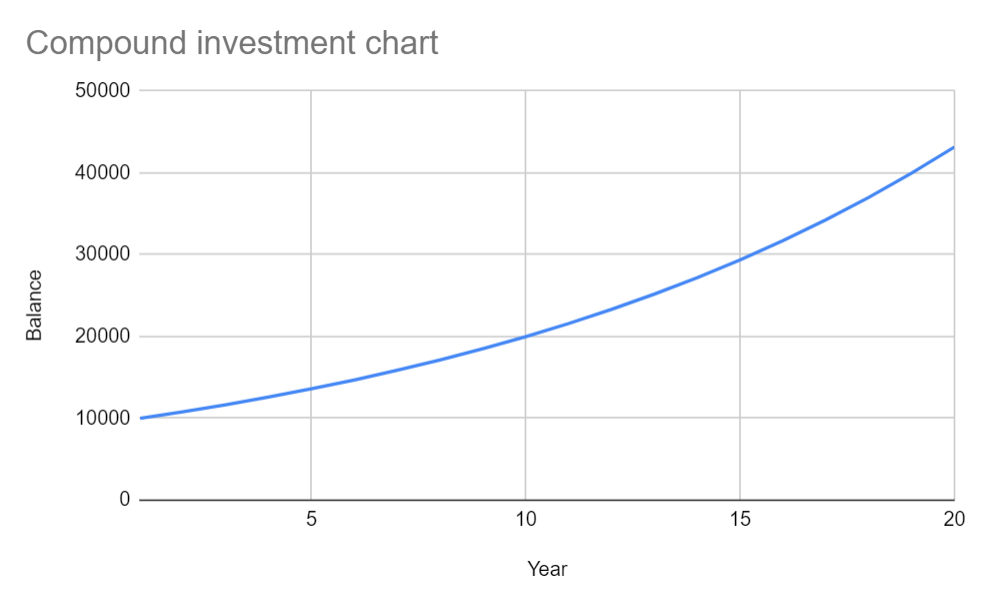

Notice the curve of the line? This isn’t a straight line – it’s a curve that gets steeper the further along we go. That’s the effect of compounding.

This chart visually represents the power of compound interest over a 20-year period. The horizontal axis shows the time in years while the vertical axis shows the total balance of the investment. We begin with an initial investment of $10,000. Assuming a consistent annual return of 8%, you can see how the investment grows over time and totaling $43,157. That’s a profit of $33,157!

Compound interest is the process where interest is added to the original principal, and then further interest is calculated on this new total. Simply put, it allows you to earn “interest on interest,” accelerating the growth of your investments over time. The more frequently the interest is compounded and the longer the money is left to grow, the more significant the benefits of compound interest become. It’s a concept that highlights the power of time in bolstering your investment’s growth.

Test it with Compound Interest Calculator

This principle strengthens the case for staying patient and maintaining a long-term investment viewpoint. Avoid getting swayed by short-term market fluctuations or attempting to time the market. Keep your eyes on your investment goals and adhere to your strategy. Historically, the stock market has demonstrated consistent growth over long periods, rewarding patient investors rather than those enticed by short-term market shifts.

For instance, a $10,000 investment in the S&P 500 index back in 1980 would now be worth over $1.1 million, thanks largely to the power of compound interest. If you had tried to time the market by frequently buying and selling based on short-term fluctuations, you’d likely miss out on such impressive long-term gains. So remember, time and patience are your allies in the journey of long-term investing. A popular saying to remember is “Time in the market beats timing the market”.

Managing Your Spending

One of the foundational pillars of successful investing is managing your spending efficiently. It’s an often overlooked aspect that directly influences your capacity to invest. By developing a budget and sticking to it, you can control your financial outcomes, freeing up more money to contribute towards your investment goals. Proper money management involves distinguishing between needs and wants, prioritizing savings, and eliminating unnecessary expenses. Remember, every dollar saved is a dollar that can be invested for future growth. This discipline not only strengthens your current financial situation but also amplifies the potential of your long-term investment strategy.

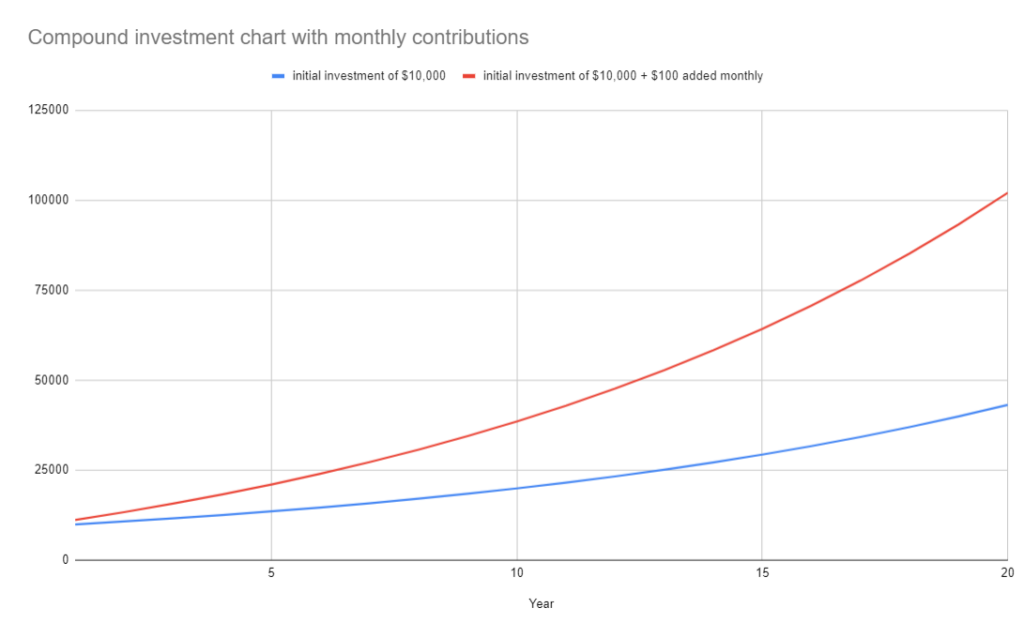

In the case of adding an extra $100 per month to your investment, this consistent addition allows for more money to continually earn interest. While the $100 might not seem like a lot at the time, over the years it adds up, and the interest earned on those additions compounds, leading to substantial growth in your overall investment.

Exponential Growth: Witness the Steeper Curve with Regular Monthly Contributions Harnessing Compound Interest Over 20 Years.

This chart visually demonstrates the amplified power of compound interest coupled with consistent monthly contributions over a 20-year period. The horizontal axis represents the time in years, while the vertical axis represents the total balance of the investment. Starting with an initial investment of $10,000, with a consistent 8% annual return, and by contributing an additional $100 every month, you can see how the investment grows exponentially over time, reaching over $100,000. This is more than $90,000 in profit! The steeper curve in the chart compared to the previous one underscores the significant impact of regular contributions on your long-term investment growth.

In other words, monthly contributions enable you to harness the power of compounding more effectively, and the longer your investment period, the more pronounced the effect becomes. This is why financial advisors often recommend regular contributions to your investment portfolio or retirement account as a cornerstone of a sound long-term investment strategy. An added benefit of saving more each month is that it could potentially expedite your journey to financial freedom, as a higher savings rate can reduce the income you need to maintain your lifestyle.

The Power of Dollar-Cost Averaging

Dollar-Cost Averaging (DCA) is an investment strategy in which a person invests a fixed amount of money into a particular investment, like a stock or mutual fund, on a regular schedule regardless of the asset’s price. The goal is to slowly build up a position in the investment over time rather than investing all at once.

The primary benefit of DCA is that it reduces the risk of making a large investment when the price is high. By spreading out the investment over time, the investor buys more shares when prices are low and fewer shares when prices are high, potentially lowering the total average cost per share of the investment.

For example, if you decided to invest $100 in a mutual fund every month, some months you would buy more shares (when the price is low) and some months you would buy fewer shares (when the price is high). Over time, this could result in a lower average cost than if you had invested a lump sum all at once.

DCA can be a good strategy for long-term investing as it allows for disciplined saving, mitigates timing risk, and can lower the average cost per share. However, it’s important to note that like all investment strategies, DCA doesn’t guarantee profit or protect against loss in declining markets.

Monitor and Rebalance Your Portfolio if Needed

Make it a routine to review and rebalance your investment portfolio. Market movements and changes in your financial status can cause your asset allocation to stray from your initial strategy. Rebalancing, which entails selling well-performing investments and buying more of the underperforming ones, realigns your portfolio with your target allocation. This disciplined approach helps maintain your risk tolerance level and optimize returns.

For example, if your target allocation is 60% stocks and 40% bonds, but market gains cause your stock allocation to surge to 70%, you’ll need to sell some stocks and buy more bonds to restore your initial 60/40 allocation. This rebalancing ensures your portfolio stays in sync with your risk tolerance and investment objectives.

Understand Regulatory Compliance in Investing

Financial market regulations play a crucial role in ensuring transparency, stability, and accountability. One key regulation is the Legal Entity Identifier (LEI), a unique code assigned to legal entities involved in financial transactions. LEIs aid in identifying and tracking entities in financial activities, providing advantages to corporations, banks, investment funds, and government bodies.

Adopting LEIs enables regulators and market participants to enhance risk management, track systemic risks, and boost transparency in financial transactions. By improving data aggregation, analysis, and reporting, LEIs facilitate informed decision-making and a resilient financial system. LEIs also contribute to fraud prevention, money laundering deterrence, and regulatory compliance. As regulations continue to evolve, adopting measures like LEIs strengthens the financial ecosystem’s security and efficiency.

Read more about Why are LEI codes important

Take Note of the Fees

Investment fees are a critical factor as they can significantly affect your overall returns. One fee to consider is the expense ratio, which is an annual fee charged by mutual funds or exchange-traded funds (ETFs) to cover management costs. For instance, if a mutual fund’s expense ratio is 1%, you’d pay $10 annually for every $1,000 invested.

Additionally, consider the commission, the fee a broker charges to execute a trade. This fee can vary based on the broker and type of investment, ranging from a flat fee to a percentage of the transaction value. For example, buying 100 shares of a stock at $50 per share with a commission of $5 incurs a total fee of $5 for the transaction. Be aware that some investment platforms might also charge account maintenance fees, transfer fees, or other fees.

Always scrutinize all the fees associated with an investment before making a decision, as they can accumulate over time and influence your overall returns.

Fees associated with mutual funds and ETFs (Exchange Traded Funds) can typically be found in the fund’s prospectus or on the fund’s information page on the financial institution’s website. The most common fee you’ll come across is the expense ratio, which is used to cover the fund’s annual operating expenses.

Here’s how to find the fees for mutual funds or ETFs:

- Prospectus: The prospectus is a comprehensive document that offers an in-depth view of the mutual fund or ETF. It covers everything from the fund’s investment strategy and manager’s background to its fee structure. As an example, if you’re considering investing in Vanguard’s S&P 500 ETF (ticker: VOO), you can access its prospectus directly from the Vanguard website. You’ll find the expense ratio listed under the “Fees and Expenses” section.

- Fund Fact Sheet: This document is a concise summary that highlights key details about a mutual fund or ETF. It often includes the expense ratio, performance data, top holdings, and other pertinent details. Using the same example, you can find the VOO fact sheet on the Vanguard website, providing a quick snapshot of the fund’s operations.

- Financial Institution’s Website: The website of the institution offering the mutual fund or ETF will typically display information about the fund, including the expense ratio and other associated fees. For instance, if you’re looking at iShares Core S&P 500 ETF (ticker: IVV), you can visit the iShares website for a breakdown of the fees.

- Financial News Websites: Websites like Morningstar and Yahoo Finance provide comprehensive financial news and investment information. They have a wealth of data on mutual funds and ETFs, including the expense ratio. For instance, inputting “VOO” or “IVV” into the search bar on either site will give you an overview of the fund, its performance history, and expense ratio among other details.

Other fees could include sales loads, redemption fees, and account service fees. It’s important to consider all of these fees when evaluating the cost of a mutual fund or ETF investment.

Maxing Out Your Roth IRA (For USA Readers)

For readers based in the USA, a key strategy for long-term wealth growth is making the most of tax-advantaged accounts like a Roth IRA. In 2023, the contribution limit for a Roth IRA is $6,000 annually, or $7,000 if you’re age 50 or older. With a Roth IRA, you contribute post-tax dollars, allowing your investments to grow tax-free. This means you won’t owe taxes when you withdraw funds in retirement. By consistently maxing out your Roth IRA contributions each year, you can significantly boost your retirement savings and benefit from compounding returns over time.

Conclusion

Investing is a journey that demands patience, knowledge, and a forward-thinking mindset. Long-term investing, in particular, can be a powerful vehicle for wealth creation. The strategies outlined in this article – setting clear investment goals, understanding risk tolerance, diversifying your portfolio, staying informed, embracing a long-term perspective, utilizing dollar-cost averaging, regularly rebalancing, and adhering to financial regulations – all play a crucial role in this journey. It’s also vital to consider investment fees and strive for fiscal responsibility by managing personal expenditures. Additionally, for our readers in the United States, fully leveraging tax-advantaged accounts like the Roth IRA can offer significant benefits.

We also delved into the principle of compound interest, which is fundamental to the growth of long-term investments. Our examples, illustrated through Google Sheets charts, highlight the exponential growth potential of investments when compound interest works in tandem with regular monthly contributions.

Remember, investing isn’t a race – it’s more of a marathon. The strategies and principles discussed in this article are not quick fixes; they require time to yield results. So, as you navigate your financial journey, be patient, stay informed, and keep a long-term perspective. If you do, the power of long-term investing can work in your favor, potentially leading you to greater financial freedom and security. Happy investing!